Category Archives: CULTURE

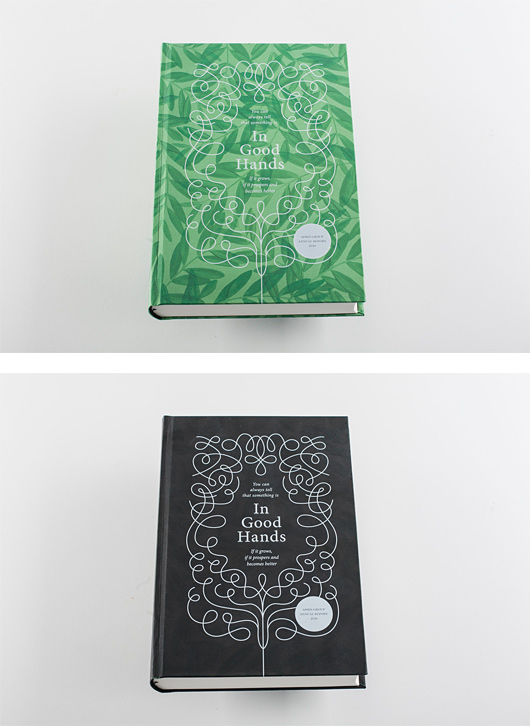

Adris Group Annual Report by Bruketa & Zinic

“In Good Hands” is the title of this annual report designed by Bruketa & Zinic for Adris Group, a company that is owned by its employees and (probably for that very reason) has grown in the past year, despite the crisis.

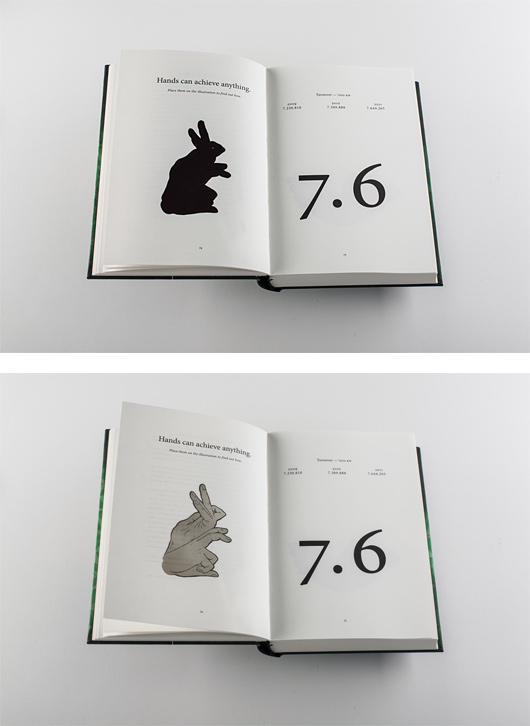

The book literally “grows green” when heated by the palm of the reader’s hands, metaphorically illustrating how hands can achieve anything – brilliant idea and execution.

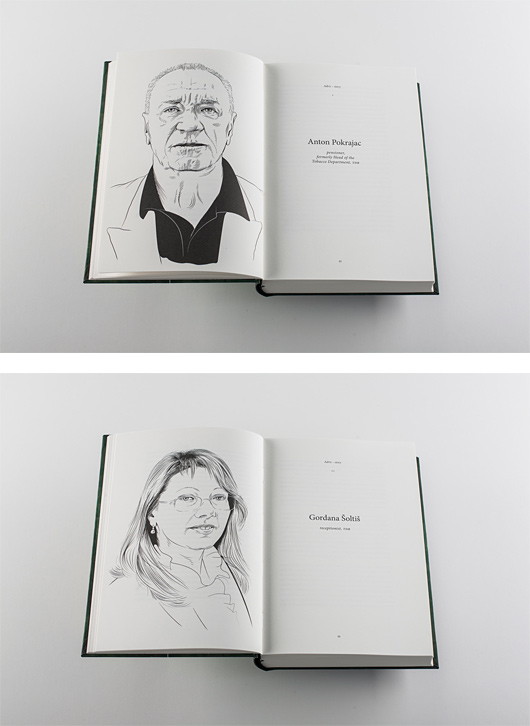

“The same especially calibrated thermo color as on the covers was used for the inside illustrations, and the concept of the annual report is also evoked by the short stories where workers-stockholders share their personal view to the past, future and influence of Adris group on their lives.

Another specific feature of this annual report is its digital version adjusted for the iPad, being one of a kind in Croatia. The annual report for the iPad makes its distribution easier, enables a higher level of interaction and makes it possible to refresh information even after its publication. Since the reader interacts with the printed book with the heat of his palms (touch), the same principle was applied to the iPad version.”

Nike Reports $6.7 Billion in Revenue for Fiscal 2013 First Quarter Results

NIKE, Inc. (NYSE:NKE) today reported financial results for its fiscal 2013 first quarter ended August 31, 2012. Strong demand for NIKE, Inc. brands propelled first quarter revenue to new record highs. As expected, diluted earnings per share were lower due to lower gross margin, higher SG&A and an increase in the tax rate.

“We had a strong first quarter and a great start to the fiscal year. NIKE, Inc. delivered an amazing array of innovation across some of the biggest moments in sport,” said Mark Parker, President and CEO, NIKE, Inc. “Innovation is how great companies sustain growth and build competitive separation,” Parker added. “We’ll continue to make strategic investments across our portfolio of businesses to capture our full potential over the long term and drive shareholder value.”*

First Quarter Income Statement Review

- Revenues for NIKE, Inc. increased 10 percent to $ 6.7 billion, up 15 percent on a currency-neutral basis. Excluding the impacts of changes in foreign currency, NIKE Brand revenues rose 16 percent, with growth in all key categories and every geography except Japan. Revenues on a currency-neutral basis for Other Businesses increased 9 percent, while Businesses to be Divested grew by 6 percent.

- Gross margin declined 80 basis points to 43.5 percent. Gross margin continued to benefit from pricing actions and product cost reduction initiatives, however, this was more than offset by higher input costs, primarily materials and labor. In addition, gross margin was negatively impacted by a shift in the Company’s mix to lower margin businesses within the NIKE Brand and the conversion of the China market to direct distribution for Converse.

- Selling and administrative expenses grew at a faster rate than revenue, up 18 percent to $2.2 billion. Demand creation expenses increased 29 percent to $891 million due to marketing support for key product initiatives, as well as support for the Olympics and European Football Championships. Operating overhead expenses increased 12 percent to $1.3 billion due to additional investments made in the wholesale business to support growth initiatives and higher Direct to Consumer costs from the addition of new stores over the last year.

- Other income, net was $29 million, comprised primarily of foreign exchange related gains. For the quarter, the Company estimates the year-over-year change in foreign currency related gains and losses included in other income, net, combined with the impact of changes in foreign currency exchange rates on the translation of foreign currency-denominated profits, decreased pretax income by approximately $28 million.

- The effective tax rate was 27.5 percent compared to 24.3 percent for the same period last year. The effective tax rate was higher due to a larger percentage of earnings coming from higher tax countries, primarily the United States, as well as a higher effective tax rate on operations abroad.

- Net income decreased 12 percent to $567 million while diluted earnings per share decreased 10 percent to $1.23, reflecting a 3 percent decline in the weighted average diluted common shares outstanding. In a press release issued on May 31, 2012, the Company announced its intention to divest of the Cole Haan and Umbro businesses. Pro Forma diluted earnings per share, excluding the results of the Businesses to be Divested, would have been approximately $1.27, down 9 percent compared to the first quarter of fiscal 2012 on a comparable basis.**

August 31, 2012 Balance Sheet Review

- Inventories for NIKE, Inc. were $3.4 billion, up 10 percent from August 31, 2011, in line with revenue growth, and reflecting strong demand for NIKE, Inc. products.

- Cash and short-term investments were $3.3 billion, $433 million lower than last year as share repurchases and dividend payments increased year-on-year and the Company made debt repayments.

Share Repurchases

During the first quarter, NIKE, Inc. repurchased a total of 8.2 million shares for approximately $779 million as part of its four-year, $5 billion share repurchase program, approved by the Board of Directors in September 2008. As of the end of the first quarter, the Company has purchased a total of 58.5 million shares for approximately $4.9 billion under this program. On September 19, 2012, the Company announced that its Board of Directors approved a new four-year, $8 billion program to repurchase shares of NIKE’s Class B Common Stock. During the second quarter of fiscal 2013 the Company’s current $5 billion share repurchase program was completed, and the new program commenced.

Futures Orders

As of the end of the quarter worldwide futures orders for NIKE Brand athletic footwear and apparel, scheduled for delivery from September 2012 through January 2013, totaled $8.9 billion, 6 percent higher than orders reported for the same period last year. Excluding currency changes, reported orders would have increased 8 percent.*

Conference Call

NIKE management will host a conference call beginning at approximately 2:00 p.m. PT on September 27, 2012, to review first quarter results. The conference call will be broadcast live over the Internet and can be accessed here. For those unable to listen to the live broadcast, an archived version will be available at the same location through 9:00 p.m. PT, October 4, 2012.

About NIKE, Inc.

NIKE, Inc., based near Beaverton, Oregon, is the world’s leading designer, marketer and distributor of authentic athletic footwear, apparel, equipment and accessories for a wide variety of sports and fitness activities. Wholly-owned NIKE, Inc. subsidiaries include Cole Haan, which designs, markets and distributes luxury shoes, handbags, accessories and coats; Converse Inc., which designs, markets and distributes athletic footwear, apparel and accessories; Hurley International LLC, which designs, markets and distributes action sports and youth lifestyle footwear, apparel and accessories; and Umbro International Limited., a leading United Kingdom-based global football (soccer) brand. For more information, NIKE’s earnings releases and other financial information are available on the Internet at http://investors.nikeinc.com and individuals can follow @Nike.

* The marked paragraphs contain forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties are detailed from time to time in reports filed by Nike with the S.E.C., including Forms 8-K, 10-Q, and 10-K. Some forward-looking statements in this release concern changes in futures orders that are not necessarily indicative of changes in total revenues for subsequent periods due to the mix of futures and “at once” orders, exchange rate fluctuations, order cancellations and discounts, which may vary significantly from quarter to quarter, and because a significant portion of the business does not report futures orders.

** The marked paragraph contains references to non-GAAP items. Presentations of comparable GAAP measures and quantitative reconciliations can be found in the tables of this press release or on NIKE’s website, http://investors.nikeinc.com.

Inside The Brooklyn Nets’ Barclays Center

Nilay Patel joins SB Nation’s Amy K. Nelson to take a look around Brooklyn’s new insanely high-tech stadium, The Barclays Center.

Triumph Desert by Drags and Racing

If it wasn’t for the modern engine under the gas tank, the Triumph Desert motorcycle by Drags and Racing would appear to come right out of World War II. This custom build on the Triumph Scrambler frame mixes a vintage aesthetic with modern muscle. It appears both earthy and aggressive, sporting a fatigue-colored paint job and a metal cage over the headlight. Whether you’re heading out on a road trip or across town, you’ll be turning heads from old and young motorcycle enthusiasts alike.

Source

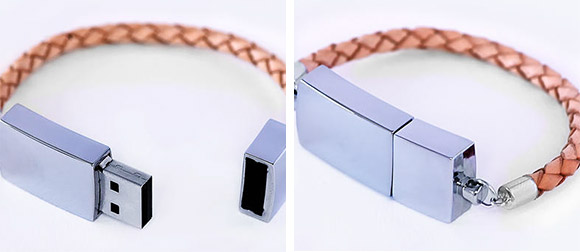

By Nordvik Leather USB

This piece of unique leather USB is one of the Scandinavian USB collection, which is created by Scandinavian designer company By Nordvik.

Kanye West vs. Chromatics: Lady High (Carlos Serrano Mix)

Kidult: Visual Dictatorship

KIDULT ” Visual Dictatorship” from misery on Vimeo.

In his latest video Kidult delivers a powerful reminder touching on the current state of corporatism merging with the worlds of fashion and graffiti. Putting his work in context by juxtaposing himself against names including including Christian Louboutin and Marc Jacobs, the Paris-born graffiti sprayer effectively presents a commentary on high fashion’s bastardized use of the street art form. Divulging additional footage of his tags on numerous commercial storefronts, the video also follows Kidult Army crews through Hong Kong, Paris and New York accompanied by dialogue throughout.

Conference of Cool.

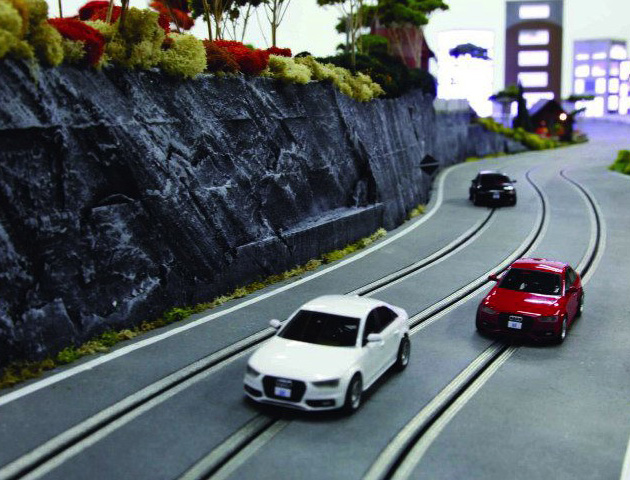

The Audi Quattro Slot Car Experience

Handcrafted 20 ft x 7 ft custom-track environment

Creating a raceway of this size, scope, and detail takes more than a walk to the corner hobby store. So we commissioned the world-renowned track builders from Slot Mods USA to handcraft the course.

Scale model Audi A4 slot-car body and four-wheel drive chassis

Every detail matters. So when model-year-accurate Audi A4 slot cars couldn’t be sourced, we simply made them from scratch. An industrial laser scanner was used to generate the digital outline, then body shells were created on a 3D printer and paired with separately sourced four-wheel-drive slot car chassis.

Mimicking quattro®’s cornering capabilities

By their very nature, slot cars are designed to come off the track. The Audi advanced quattro® all-wheel-drive system on the other hand, is specifically designed to help you do just the opposite. To reproduce the Audi A4 handling characteristics in a slot car, we spent hours testing and custom tuning the traction magnets on each vehicle – while still leaving enough play for racing to remain competitive.

Custom in-car cameras, housing and transmitter

Most slot car POV video footage is shot using a mountable camera strapped to the roof of the car. Not good enough for Audi. So we adapted miniature spy cams to fit inside the car, with custom circuitry to wirelessly transmit the live stream. A custom housing was also built into the 3D printed body shell to help minimize camera shake and vibration.

First of its kind: iPad slot-car controller

In a typical slot-car setup, drivers use a handheld resistor to modulate voltage to the track and, in turn, the speed of the slot car. This nearly 100-year-old system forces the driver to race from a bird’s-eye view trackside, instead of the driver’s seat where they should be. To change this, we developed a custom iPad app to pair with our in-car cameras – putting the driver right in the cockpit for the first time ever. And instead of the traditional electric controller, a digital thumb control interface was created to regulate acceleration and deceleration.

10 Reasons why High Fashion is Beating Streetwear at its Own Game

Highsnobiety Article –

One of the main trends that we have been witnessing in recent years is the steady move of high fashion brands into the streetwear market. Entire brand relaunches have been based on it, with Givenchy maybe being the most prominent one. When talking about streetwear, we do not mean denim or leather jackets, we mean bold graphic t-shirts and attention seeking sneakers. When a few years ago high fashion was exclusively known for premium materials and proper cuts, today things look a little different. Their graphics have become very interesting and their expertise in fabrics and special treatments is obviously also adding to the appeal of their products. Givenchy, Christopher Kane, Paul Smith, Marc Jacobs producing all over print tees is nothing new anymore. Margiela and Louboutin making solid sneakers that might actually get more eye balls than the latest Nike Dunk is also routine at this point. Has the consumer changed, has streetwear not been able to defend its own territory or what else could have caused this change?

One thing is for sure, after we have seen extremely bold moves in streetwear from brands like The Hundreds, 10.Deep, A Bathing Ape and others in the 2005-2007 period, with the crash of the global economy, everybody focussed again on more timeless and quality garments. Maybe this recent trend is the follow-up to the extreme simplicity that we have witnessed in recent years.

Here below we have worked on 10 reasons that we believe make High Fashion beat streetwear at its own game at the moment.

- Credibility – Because of their expertise and history in the high fashion industry anything that the High Fashion labels create can only be the best.

- Quality – The High Fashion brands have a greater range of possibilities to work with the highest quality fabrics and the best manufacturing facilities.

- Designers – Pulling great designers from everywhere with promising career possibilities for most reasonable payment the High Fashion brands have the best sources of fresh, skilled, best educated designers.

- Innovations – Working with newest developements also in the scientific area High Fashion brands can afford to research and use new inventions to optimize fabrics and give their collection items new aspects.

- Collaborations – Because everybody wants to work with the top designers, there are never ending options of collaborations with brands, labels and artists always creating new special editions.

- Independence – Not having to rely on retailers because the High Fashion brands mostly have their own stores to sell the products they are independent to take their freedoms.

- Difference – Sneakers have become so common and widely accepted in society that they are worn by the masses. Unique in this environment is who differentiates himself by wearing a sneaker that is not mass produced.

- Communication – Having the resources to commission huge campaigns to advertise with testimonials that draw highest attention and have real credibility.

- Exclusivity through availability – The demand for High Fashion is higher than the availability. Often the brands release less quantity that is exclusively to purchase in their own flagship stores.

- Exclusivity through pricing – The high prices for those High Fashion brands are often higher than the usual customer can and regularly afford which creates an even higher desire for those items.

Olafur Arnalds & Nils Frahm: Stare EP

Words from Nils Frahm:

“I heard ‘Eulogy For Evolution’ for the first time 6 years ago and I was totally captivated. Impossible to know back then that I was supposed to meet Ólafur many years later as my label mate. Later when he took me along a tour of his we also noted that we kind of like hanging out together, doing important things like cover versions of long forgotten songs or eating veggie pizza. Also he would join my live set for a jam and I would return the favour by playing along with his set.

All in all, I fell for Óli and after one memorable jam session we had in Berlin at Roter Salon in 2011, he finally proposed the idea to visit me in my studio in Berlin to work on ‘some music’. I was happy and delighted about that idea, so we got together in April 2011 and after having a big pizza, I plugged in some old analogue synths and we played for four days until late in the night. Also queen Anne Müller stopped by after a show with Agnes Obel to record some cello at 5 am in the morning for ‘b1’. Making music together with people is lovely!

The time I spent with Óli in Berlin made me very happy and the music wasn’t like anything I have heard before. It was all very reduced and minimal and I felt like I couldn’t have done this alone. So we decided to do another 4-day jam at Óli´s E7 studio in Reykjavik. So I flew there in the end of October to repeat the trick and record some out of this world ambient music. It didn’t take us too long to write ‘a1’ and ‘a2’. I can’t wait for the follow up!”

Words by Olafur Arnalds:

“After having toured together and having had many inspiring late night conversations, I decided to visit Nils in his Durton Studio in Berlin for a weekend. We didn’t have anything specific in mind, we just wanted to hang out, jam and eat some falafel. That’s what we did, but somehow we also made 25 minutes of ambient bliss that weekend.

After that we quickly decided we had to do the same in my studio in Iceland. Just hang out for a weekend and possibly make some music. So the album became kind of an Iceland vs. Berlin thing. I think you can hear it very well in the sound (side a vs. side b) and that is the most interesting thing about this record for me: that subtle but significant different in the characteristics of the music two people made in Iceland against what the same two people made in Germany.

I’m not sure why we decided to keep it secret, it just happened. But it sure was fun! I remember a party at Robert’s (Erased Tapes founder) flat in Berlin, where me and Nils stood in the corner the whole night whispering about the project. We then delivered the fully mastered record with finished artwork to Robert around the 5th anniversary of the label. It would have been nice to be there to see his face…”